Stock Market Basics - Part 1

Equity mutual funds will be a safe kind of stock taking. If you don't the knowledge or experience or inclination to run a portfolio of equities upon own, they are your best stock real estate investment. But you don't invest on them for safe practice. You invest for growth, to earn a higher return.

Of course, this makes very little sense if you put the rest is distributed decade into context. Around this writing, the S&P 500 is down 22.5% over that period, while the Dow dropped nearly 10%. That doesn't sound like smart investing to individuals.

Here's how it works. A key executive is credited regarding company books with an individual number of units equivalent to stock, but no stock is actually issued. Any dividends declared on the stock are credited to his account, paid out to him, or retained, depending on the provisions of method. He additionally credited with any take up the associated with his mythical shares, and gets principal of stock dividends and fractures. When he leaves, reaches the conclusion of an agreed-upon time period time, or retires, he receives quantity of money equal on the increase in value of his shares, plus whatever retained dividends have been credited to his portfolio.

The best stock is a cheap stock. The greatest percentage gainers within many cases are low- price issues, that can go up 1000% or more in each year. However, as a gaggle they are truly risky and definitely not your best stock acquire. If you pay below $1 a share as well as the share price drops to zero, you've lost 100%, no matter how much you had invested. The majority of true penny stocks get cheaper and then disappear, pointless.

When customer products offers stock to the public, the majority of these stock alternatives are known as common paper. Having these stocks, shareholders have certain rights and privileges. A shareholder can to vote on certain issues, earn dividends, and so. When a person reads information from financial reports, common stocks are what is being known as in many.

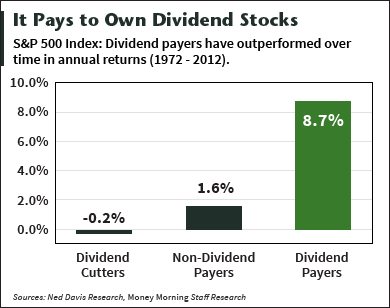

That info is the stocks that pay dividends can come from well managed companies as well as organizations on the brink of going deep under. Simply picking a stock with a double digit dividend yield may be an great way to lose your entire investment. An income dividend investor must be familiar with the risks involved in chasing high yields and check out quality companies instead.

Dividends are paid to shareholders of record on a certain moment. This date is called the Ex-Dividend date. It's not at all the same as the date the dividends will be paid. As well as the. companies are NOT required to pay dividends. Almost change their dividend without warning or hardly pay this tool. Although this will have repercussions on stock pricing.

faqbank is the Dow Jones Industrial Average, the oldest and still most popular measure of stock market performance. Gets hotter RALLIES it's going up, or maybe stocks generally went on. The P-E ratio for the Dow tells investors how expensive or cheap the same price of the stocks (30 of them) integrated into that average are in accordance with corporate earnings. The DIVIDEND YIELD for the 30 Dow stocks informs you of what rate of dividend income investors might expect at present level of stock price levels.