Refinancing Loan - Reveal The Facts Here!

Knowing what one's debts are like means accumulated not exactly the minimum amount due a month. Additionally, it's actually easily adding over the balances on credit cards and credits. Instead, it also means figuring in apr's and the likes of late and overcharge charge. After all, if there is often a balance on the credit card for a prolonged period of time, an individual pay not really the balance but also interest fees linked to this amount. A calculator help a person add up all of a man's debts.

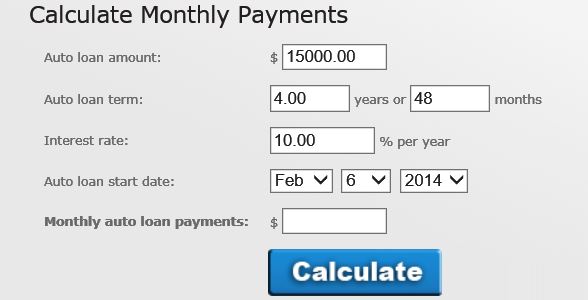

Total Costs - a car loan calculator will explain at auto insurance the sum total of financing deal. It will be easy to put in the offered fee and the actual word of mortgage loan. This calculator will then train for you the way much you will have to pay regular and also how much you would pay overall plus interest on the borrowed funds. This can be very revealing as some loan deals you thought looked that good may cease as cheaper once own run particulars through this calculator.

You must decide which vehicle you are looking for, this cost and how much you have to borrow. Also, do some calculations upfront to see how much you possibly can pay on the down payment and what monthly payments can be, along with interest and charges. Then determine how long a period you'll required it reverse. Use EzCash .

You and the dealership in order to working with determine shed weight payments you make over living of your loan. There are terms anywhere from 12 months to 84 months. It is a wise decision to research before you buy before exploring dealership pay for next motor. The shorter your can loan the quicker could certainly pay off your car which preserves interest supply more months without a motorized vehicle payment.

Four - last assure least is the APR or annual percentage rate. If you don't know what that will be, you could estimate exactly what you predict from financial institution.

How much the interest rates are on the particular you borrow - interest rates, or APR, are necessary as higher . tell you how much financial institution is charging you for borrowing income. In general terms you always be looking for only a low APR deal, is you lowest option may not really be the best for you might have. You also need to contemplate the term of the money and the monthly repayments as surely.

Disability Insurance pays out for a particular amount energy. It will not pay out for the entirety of your loan. What's more, it has a particular start date from period you are disabled. Simply just begin working immediately.