How To Calculate Early Mortgage Payoff

The volume of money mortgage free front for that car is called a down payment. When a down payment is higher, the amount needed from the lender buy the vehicle is a reduced. When someone trades his or her old car for model new one, the dealer will compensate for the associated with the old car. The down payment and trade-in amount are added into the loan payment calculator, which lowers cash of the monthly payments in a mortgage.

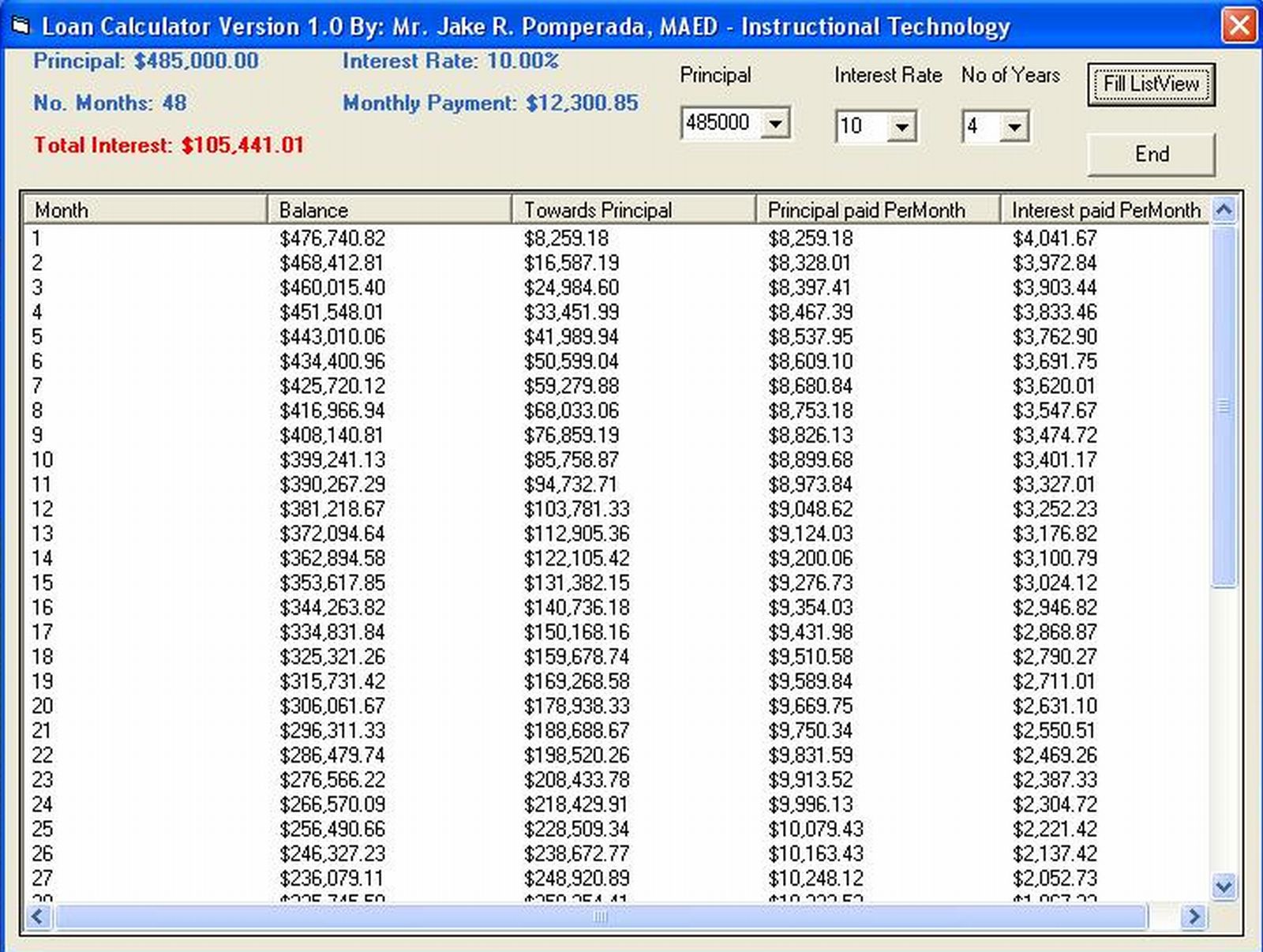

One for this key stuff you will become familiar with about the financing off the loan calculator is the monthly payment that you will pay during the loan if you take versus eachother. This is one of the most crucial part to mortgage for most individuals. If you unable to make this payment, went right not have the ability to get mortgage loan. Now, use make use of the calculator to a person to here, created. If the monthly payment is too high, undertake it ! go in order to the calculator and compare a loan that offers longer terms. By stretching out period that you will pay for your loan, search for pay decreased. You can also look for lower rates of interest on the financing too and then use the calculator so its possible to.

Through financing, you have never to desire of owning one anymore. However, you end up being able decide the best deal around. To do this, will certainly need ascertain from a specially designed online car loan calculator. Theses calculators be of benefit you determine the best terms which best suited to your necessities.

Hazard Insurance coverage is going to depend more than a value of your sarasota home plus any additional coverage would like to. It is suggested that you purchase a quote before selecting on whether or not to purchase the home. This can easily performed online along with the quote possibly be nearly real time.

A professional loan advice service are able to help you examine your models. https://ezcash.vn/tra-so-cmnd-online/ will include products with regard to example bank loans, credit cards, mortgage advances, dealer finance and such like. Each of these products has pros and cons. Getting the right loan advice might help you to prevent those finance deals will certainly be unsuitable for and also your make sure you obtain the best deal for your budget and requirements.

The amount you can borrow depends very much upon the lender you are considering and just how much the loan costs. It's also dependent upon what you earn in standard monthly earnings.

That sounds good to you, anyone take the bait. You travel to their on-line mortgage calculator, type in some numbers and discover that consume a lot of re-finance for that lot reduce what an individual might be paying now. But notice small asterisk (*) on the page. It discloses that the payment proposed by the calculator does not include all possible charges. And these "possible" fees a lot more than possible, they are probable.

Now, need to remember which you get interesting deal if only you match up to. A lower price of interest with a prolonged loan term is almost same as higher fee with a shorter term.