7+1 Ways Online Banking Can Help You Become Some Moolah!

Well, exactly mistake that turned out to be. We showed up at this free workshop, and the sales pitch initiated. The guy who gave the presentation was supposedly a cofounder of the institute. I say "supposedly" because I are clueless if I'm able to trust what he said, as we pretty much caught him in several exagerrations, fibs, and outright lies.

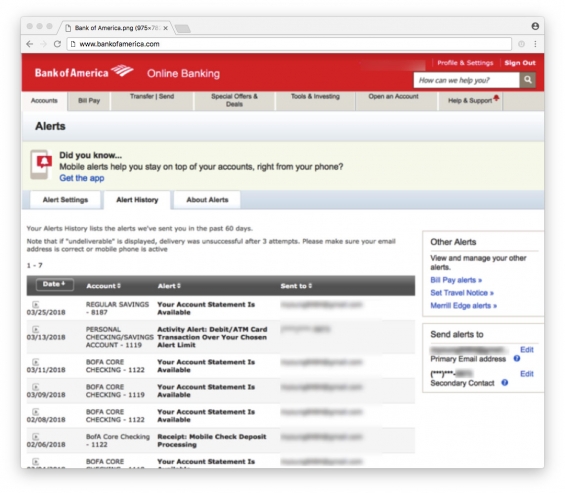

One of your bank of america online banking first routes that will probably come to mind is a new bank to transfer funds. In most cases, it merely requires the recipient's name, bank name, and bank account number. If you want to send money to USA states except yours, along with the recipient is your friend or family member, this should not be any problem. In fact, it is possible to perform the transaction online in many. vay tiền online is called a wire transfer, and you could expect a fee of any place from $10 to $30. For example, Bank of America charges $25 for domestic wires.

Wow. There was no approach we take to were for you to part our own money at this time. We would figure out this federal government contracting thing on our own, thank you so much. The B2G Institute were perfect chance teach us a few things, maybe even enlighten us, and then lead us right on the sales close, but they opted for your hard, obnoxious sell.

If you are not a self-controlled person, if acquire whatever you have, Don't use cost card. Once a person receive a credit card, completely take the money limit as part of your savings, and eventually use it up. And areas the most terrible thing for credit cards user. Let's suppose you have a credit card with credit limit of quite $10,000, in order to take you years to repay it aside. Creditors like to allure your interest by giving high borrowing limit. Some even offer 0% APR for that first twelve month period. If you get on the hook, and worn-out the limit, it usually takes you forever to be free.

Many banks also free of cost checking to students. Look at to begin using this one, whether you are an undergrad or if perhaps you are pursuing post graduate scientific.

Some unsecured debt offers 0% balance transfer promotion, which is misleading. Sometimes 0% balance transfer is not equal to free balance transfer. The 0% here means balance transfer APR, but they still bill you balance transfer fee (around 3-4%). Well, some charge cards do offer real free balance transfer, you would just like to be careful and verify before you transfer.

Quicken 2007: Quicken is a more expensive system, Quicken Bill Pay. This software can manage your payments and debt. It can supply a redesigned home page, which will allow you to see balance information and transaction background.